![]()

Retirement or Financial Freedom?

Retirement is not the buzz word anymore. My observation is been that everyone is really looking for Financial Freedom and that too much earlier than retirement. Retirement is a just a last phase of your Financially free life.

Now you may be wondering that what is the difference between these two. Financial Freedom is when you continue to work (especially on something you working) but not for money and there is no financial dependency on the money you earn out of that work. This is the time where you want to pursue the hobbies, follow your passion which one could not while working. Retirement is when one actually stops working.

As a result of this change in thought process of quite a few people, it is important that you plan for Financial Freedom. Now, when do we start planning for Financial Freedom? Here is my take on that.

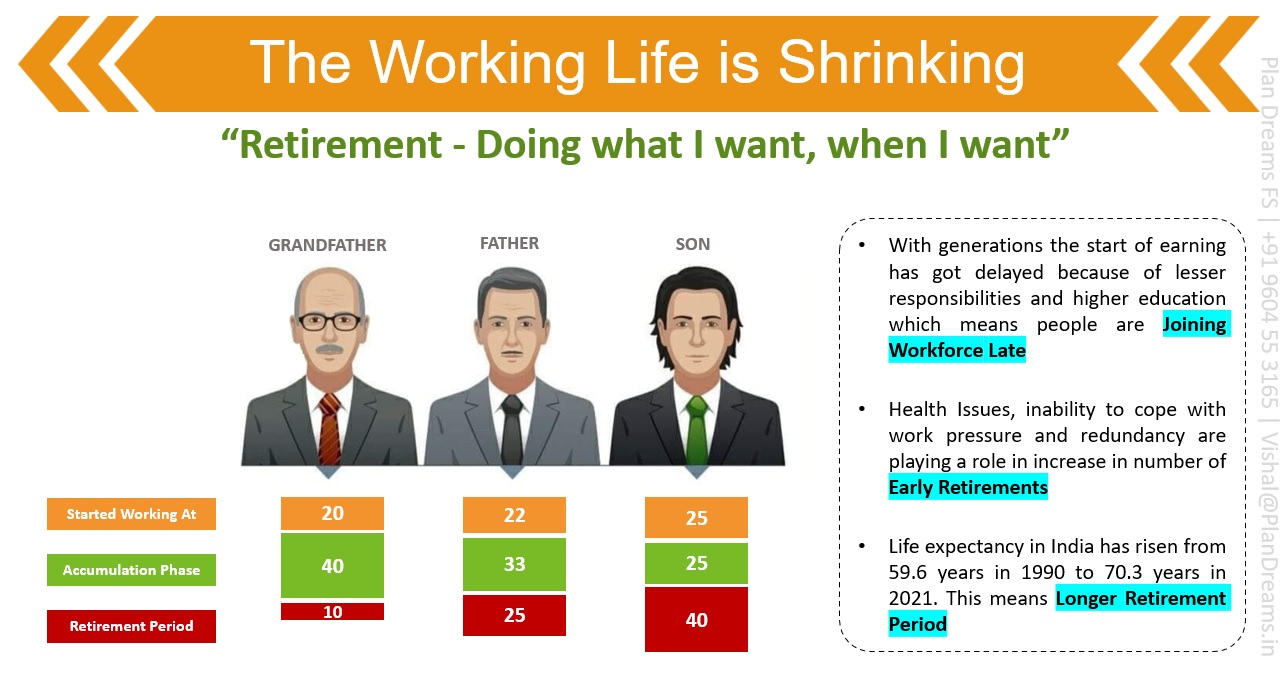

The working life is shrinking

At one end the age to start to earning is getting delayed and at the other end, the age to achieve financial freedom has reduced. On top of that the life expectancy has increased and hence it is important that one starts planning, saving and investing as soon as he/she starts earning.

Important tips to save/invest for Financial Freedom

- Get your equation right. (Spend on wants = Earnings – Spend on Needs – Savings/Investments). One should spend on wants what is left after spending on needs and saving /investment done. One should at least be able to save/invest 20%-30% of earnings.

- Clearly differentiate between your needs and wants.

- Avoid bad debts like Credit Cards, Car Loan, Personal Loans.

- Even while going for good debt (taking home loan), make sure that EMI outflow is not more than 30% of your inflow/salary.

- Invest with proper guidance. Young generation trust their parent’s advice the most. This may create a problem if they do the same while taking decisions about their savings and investment. Things were different with the earlier generation when it comes to savings. The same saving principles would not work today. E.g. PPF interest rate used to be 12% in the late 90’s. But the current interest rate is hardly able to beat inflation. That’s where asset allocation, investment (not only saving) becomes important.

- Avoid Insurance products bought for investment purpose which is definitely not the way to go. One should keep Investment and Insurance separate.

Very well researched and articulated write up Vishal – Kudos to you 👍🏼😊

Thank you so much Nilesh for your kind words. It means a lot.

Very True… The early we plan for this the early we achieve the financial freedom

Yes. You said it Sachin. Thanks.

Thank you for the good summary on retirement mindset and approach to savings and expenses in the modern economy perspective.

Thanks Jayaraj for your kind words.

An eye opener for a software professional like me. I will reach out to a professional to help me with my financial Freedom planning and implementation. A big thank you Vishal

You are welcome Prem. I am glad that this helped you

Very true!! Thank you so much vishal for your proper guidance to achieve the financial freedom.

Thanks Priyanka. It wouldn’t have been possible without your and Saurabh’s trust and strong drive to get things sorted out for yourselves.

Much informative with on point facts!

Thanks Ruchika 🙂