![]()

Wealth creation is often mistaken as a purely external pursuit — a matter of the right job, good investments, or luck. But in truth, the biggest determinant of wealth is not out there. It’s in here — in your mind, your habits, and your behavior. Human behavior, ironically, is often the greatest barrier between a person and their potential wealth. Here’s how:

1. Instant Gratification Over Long-Term Gains

One of the most common behavioral pitfalls is the preference for instant gratification. We live in a world that rewards immediacy — fast food, one-click purchases, same-day delivery. This conditioning spills over into how we manage money.

Rather than investing or saving, many people spend impulsively to feel good now, undermining their future financial security. Real wealth requires patience and a willingness to delay gratification — a trait surprisingly rare, but incredibly powerful.

2. Fear and Greed in the Market

Emotions wreak havoc on financial decisions. Greed causes people to chase market highs, often entering investments too late. Fear causes panic-selling during downturns. Both result in buying high and selling low — the exact opposite of wealth-building behavior.

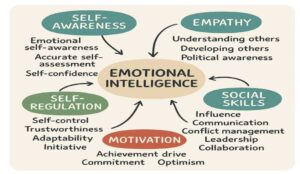

The best investors are not necessarily the most knowledgeable, but the most emotionally stable. They stay calm when others are euphoric and rational when others are terrified.

3. Lack of Discipline and Consistency

A major myth about wealth is that it comes from one big break. In reality, it’s the result of small, disciplined actions repeated over time — budgeting, saving, investing regularly, and living below your means.

But discipline is hard. Consistency is boring. And because results don’t show overnight, many give up before their habits can bear fruit. Human impatience undermines even the best financial plans.

4. Cognitive Biases and Poor Decision-Making

We’re all subject to cognitive biases — mental shortcuts that often lead to poor financial decisions. Confirmation bias keeps us in echo chambers, anchoring bias causes us to rely on irrelevant information, and herd mentality leads us to follow the crowd blindly.

Recognizing these biases is the first step to managing them. Without awareness, people end up making irrational decisions that sabotage their long-term wealth.

5. Identity and Belief Systems

Some people subconsciously believe they don’t deserve to be wealthy. Others are raised with negative associations around money — that it’s evil, or that rich people are greedy. These beliefs shape behavior and quietly sabotage financial progress.

You can’t outperform your self-image. If you see yourself as someone who “just isn’t good with money,” you’ll act in ways that make it true — even when you know better.

Master Yourself to Build Wealth

Building wealth isn’t just about mastering markets, it’s about mastering yourself. The habits, beliefs, and emotions you bring to the table are far more influential than the external factors you chase. Financial literacy matters — but behavioral discipline matters even more.

You don’t need to be a financial expert to build wealth — but you do need to be intentional. Start by observing your own behavior. Where are you impulsive? Where do fear or doubt creep in? Are you reacting emotionally to money, or acting strategically?

Track your spending for a month. Automate your savings. Educate yourself about basic investing. Most importantly, focus on building discipline and self-awareness. These internal shifts do more for your net worth than chasing the next hot stock or side hustle.

Wealth isn’t just a number in your bank account — it’s a reflection of your mindset and daily decisions. When you change how you behave around money, your financial reality will begin to change too. The journey may be long, but it’s one you control. And that’s a powerful place to start. Get going!!!

The article is superb, and ideas are presented in a compelling way. I too believe in same ideology.

Hello Vishal,

Very nicely explained and it reminded me the mistakes I had done in my past.Hope I will learn and not make same mistakes.

Many thanks.